Revolutionizing Real Estate: Blockchain’s Role in Streamlining Transactions by 2025

Talk about blockchain never seems to cool down, and now the housing market is climbing aboard. Experts expect that by 2025 buying, selling, or even renting a home could wrap up in minutes instead of dragging on for months. Because every move will land on a public ledger no one can erase, deals should look a lot less murky. Of course, any shiny new tool shows up with a few cracks, and the property world is no exception. Below, we break down the bright opportunities and the darker headaches tied to blockchain in real estate.

What Is Blockchain in Real Estate?

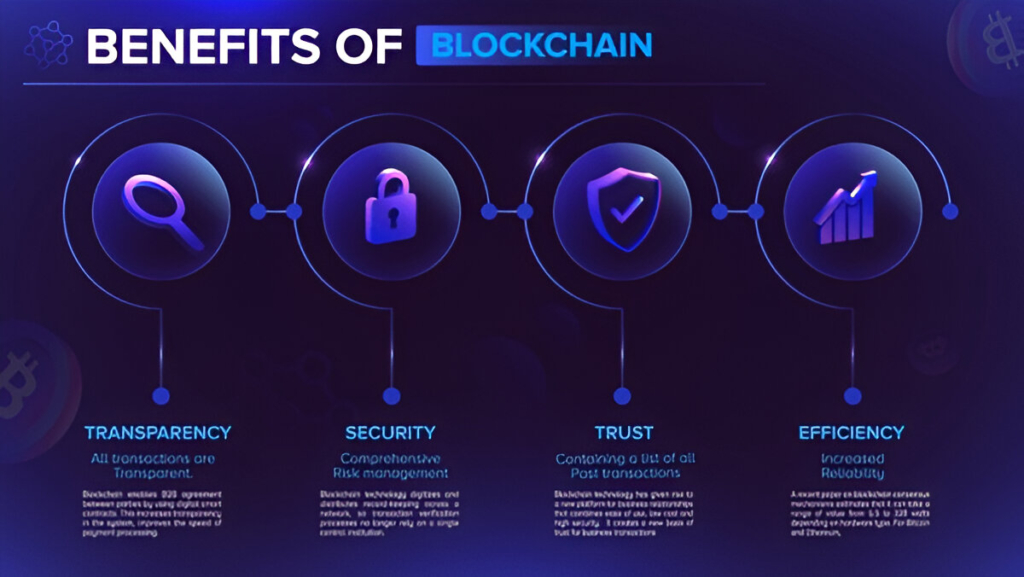

If the word blockchain makes your eyes glaze over, you are far from the only one. At its heart, it is a secure digital notebook spread across thousands of computers instead of sitting on one lonely server. Since every page gets copied to countless machines, no single hacker or greedy landlord can quietly change the records. That built-in honesty matters in real estate, where fake titles and lost paperwork have blown up deals for decades.

3 Big Ways Blockchain Makes Real Estate Better

- Clearer Records Everyone Can Trust

Picture a giant online ledger that never forgets anything. When a house changes hands, when a mortgage gets paid, or when a lien appears, that info is written once and locked away behind strong crypto security. Because all bank branches, city halls, and future buyers see the same up-to-date record, cheating with fake papers becomes really tough and everyone feels a bit safer.

Example: Before making an offer, anyone can open the app, peek at the ledger, and quickly spot who truly owns the home and if any hidden debts sit on the title. Catching trouble early saves time and money for both buyers and sellers.

- Speedy Deals and Smaller Bills

Right now closing on a house drags out for days or weeks as notaries, title clerks, and other gate-keepers shuffle papers around, hunt for missing stamps, and double-check each dot and line. Smart contracts- a kind of digital vending machine sitting on the blockchain-skip most of that busy work. When everyone hits their promise, the code automatically moves the cash and changes the deed in minutes rather than months. Fewer office hours and fewer middlemen mean lower closing costs, too.

Example: Imagine its closing day: the buyer transfers cash to escrow, a smart contract double-checks the amount, and in a heartbeat the deed moves from one digital wallet to another. That series of online steps can trim off days-maybe even weeks-giving sellers their money sooner and handing buyers the keys theyve been waiting for.

Stronger Security

Blockchains spread records over thousands of computers, making them much harder for crooks to crack than a single, locked vault. Because no one server holds every scrap of data, a hacker cant zoom in on one spot and rewrite the story. Each new entry gets its own thick layer of encryption, and any funny business lights up the network almost at once.

Picture a house deed saved on the blockchain. Once its published, no-one can scrub out past owners names or invent a fake title. That built-in trail of proof cuts the odds that a shady claim will slip through.

Improved Efficiency

Smart software on the blockchain chops away much of the paperwork that usually slows real-estate deals to a crawl. Ownership records, unpaid liens, and ID chips can be scanned in seconds instead of days. With fewer people passing the pen back and forth, lost signatures and simple mistakes happen far less, and the whole thing just moves quicker.

A blockchain wallet can show a buyers cash balance in seconds, right before closing. That quick, visible proof lets banks clear loans and real-estate agents set a signing date far earlier.

Access for Global Buyers

Blockchains really shine when property moves across borders. A buyer in Tokyo can send cryptocurrency straight to a Miami seller, skipping big exchange-rate markups and pricey wire fees. That fast, borderless payment opens luxury condos, vacation homes, and vacant lots to investors everywhere.

Negative Impacts of Blockchain on Real Estate

- Regulatory and Legal Challenges

Blockchains benefits are clear, yet governments still argue over where they fit in property law. Since rules about ownership and title registration change from state to state-and country to country-the lumpy, patchwork system slows wider use.

For example, some places still forbid digital deeds altogether, while other agencies insist that any blockchain plan passes long, costly audits first. Those local quirks tie progress in red tape and keep developers on the sidelines.

2. Complexity and Technical Barriers

For many real estate agents, lines of computer code look like a different world, and that gap can breed distrust. Moving away from paper files to an online chain usually calls for new apps, solid training, and sometimes even fresh servers-moves that weigh heavily on small offices budgets.

Picture this: a two-person brokerage faces a tough choice on whether to spend thousands on software and classes or keep relying on familiar filing cabinets, a math that often pushes blockchain to the back burner.

3. Privacy Concerns

Blockchains gleam because their ledgers are public, yet that same shine can make privacy feel fragile. Every deal gets etched into the chain forever. Though names hide behind wallet keys, anyone with a little skill can trace those keys from sale to sale.

Think of a collector who shudders at the idea that nosey viewers can map every sale of a prized item, even when no real name appears on the screen.

4. Lack of Standardization

Right now, no single blockchain has been crowned as the global go-to for property sales. Each network runs its own playbook, so swapping info between them often feels like talking two close-but-different dialects.

Picture this: a buyer in Brazil lists a condo on one chain while a seller in Germany signs in to another. Their records simply dont speak to each other. The deed transfer drags on and new fees pop up just to move the data over.

5. Resistance to Change

Paper has run the real-estate show for generations, and many agents, lawyers, and notaries trust it way more than computer code. A mix of job jitters and old routine makes them roll their eyes at a tool that looks cool but seems pointless.

Pushing a pen on a printed form still feels easier than mastering crypto wallets, and until that mind-set shifts, blockchains full promise will creep in at a crawl.

Take a veteran real-estate agent: after decades of signing papers and hunting wet signatures, she will feel safer sticking with files she can hold, not a ledger nobody really owns.

Conclusion: What Lies Ahead for Blockchain in Real Estate

Imagine speeding up closing times, safely storing deeds forever, and instantly showing who owns a house-without waiting weeks or paying extra notaries. Strip away most middlemen, and fees shrink too, leaving buyers, sellers, and lenders with more cash. That fast progress still needs clear rules, tough privacy codes, and a real move away from paper-and-signature habits we grew-up with.

By 2025 the future of block-chain in homes, lots, and offices will depend on developers, regulators, and everyday users pulling in the same direction. Those who experiment with wallet apps and smart contracts now might soon tell friends they helped build the leaner, fairer market everyone hopes for.

How to Buy MBL Signature and Get Golden Visa Benefits

After exploring block-chain s impact on property records, lets turn to a practical question: how can you invest in Dubai real estate and gain Golden Visa perks? When you invest in MBL Signature, you dont just buy a slice of the bustling market-you also open a route to long-lasting residency in the UAE.

What is the Golden Visa?

The UAE Golden Visa is a long-term residency permit that inverts the usual rules. Instead of being tied to a single job sponsor, owners, investors, and skilled professionals receive a ten-year, renewable visa simply by purchasing AED 2 million or more in real estate.

Steps to Invest in MBL Signature and Claim Your Visa:

- Choose Your Apartment Pick an upscale apartment inside MBL Signature, perched in Cluster R. The boutique tower blends breathtaking water views with five-star services, attracting quality tenants and giving owners steady security.

- Meet the Investment Criteria Your new home must be valued at AED 2 million or higher; meeting this benchmark automatically qualifies you for the Golden Visa.

- Apply for the Golden Visa Once ownership is confirmed, the visa request is quick to file and brings long-term residency along with world-class healthcare, top schools, and favorable tax rules.

- Enjoy Your Investment Renting a unit at MBL Signature lets you savour a luxury lifestyle while Duba-Time’s active market has rental yields averaging between 6 and 10 percent, making your capital work even harder.

Why Invest in Dubais Real Estate Market in 2025?

Dubai still sits at the top of many buyers pick lists, and for good reason. Sky-high growth, high-speed metro links, clear ownership rules, and no annual property tax let owners see exactly what they have and watch its value climb.

Snagging a unit at MBL Signature, or any Kingdom by MAG tower, links luxury living to a Golden Visa, so newcomers can dive straight into the energy, year-round events, and future-proof economy of one of the worlds liveliest cities. If you want solid advice before buying, Aurora Le Claire blends fresh market data with a warm, personal touch.

Reach out to Aurora for a free chat, and watch your dream of investing in Dubais sizzling property scene become reality.

Meet Aurora Le Claire: Your Trusted Real Estate Advisor

If you’re considering making a move in Dubai’s real estate market, Aurora Le Claire is the agent to have by your side. With years of experience and a passion for matching clients with the perfect properties, Aurora can guide you through every step of the process.

Hot Neighborhoods Aurora Covers

- Jumeirah Lakes Towers (JLT): Stunning high-rises with lake views.

- Palm Jumeirah: Iconic island living with unmatched luxury.

- Dubai Marina: A waterfront haven with yachts below every balcony.

- Jumeirah Beach Residence (JBR): Beachfront luxury, where life is always at the shore.

Aurora will provide you with data-driven advice, offering insights into which areas will give you the best returns, whether you’re buying to live or for rental income.

Contact Aurora Le Claire today for a no-cost consultation and find out how you can make Dubai’s real estate market work for you.

📞 Phone: +971 50 254 0128

✉️ Email: w.rejoice@kingdomproperties.ae

Why Invest in Dubai Now?

In 2025, Dubai is not just growing—it’s evolving into a global real estate hub with high rental yields, strong infrastructure, and attractive tax laws. Whether you’re seeking high returns from bulk rentals, eyeing luxury living in iconic locations, or securing a Golden Visa, Dubai’s property market offers something for everyone. With seasoned experts like Aurora Le Claire to guide you, now is the perfect time to make your move.

Invest in Dubai now and be part of its thriving future. 🌟